The Green Coffee Company Completes $9.6 million Series B Funding; Announces Upsize; To Become Colombia´s #2 Largest Coffee Producer

Series B Funding Round

We are excited to report to you that we have closed the Green Coffee Company´s (GCC) initial $9.6 million Series B funding round and now have over 180 individual investors in the business.

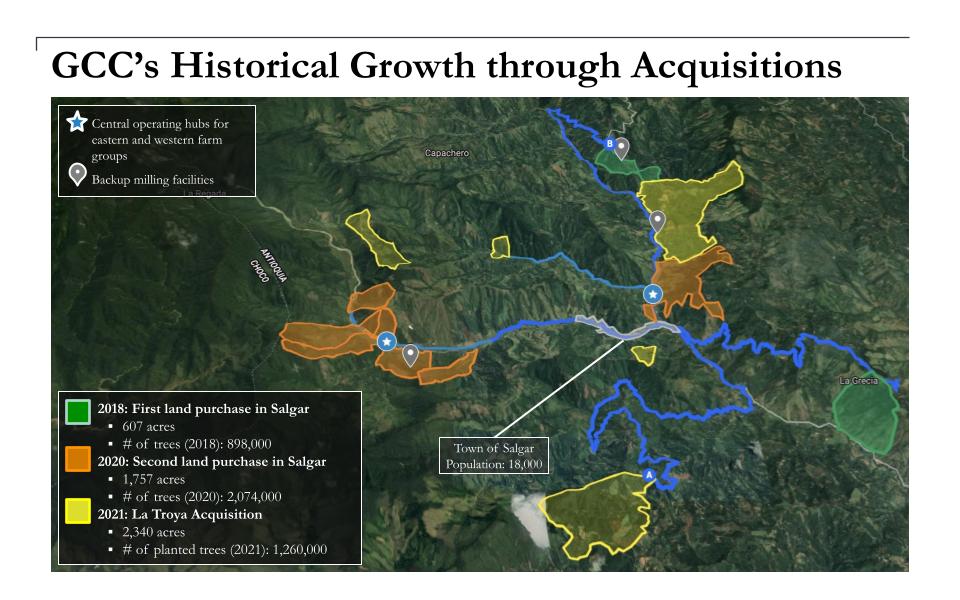

We are also proud to tell you that we have acquired an additional 2,340 acres of coffee farmland here in Colombia, almost doubling our current holdings and positioning us to become the #2 largest producer of coffee in all of Colombia.

If you would still like to invest, we have decided to upsize the Series B funding round by an additional $3.5 million to accelerate our growth plans to become the #1 producer of coffee in the country as a result of this incredible momentum and to complete the acquisition.

New Acquisition: GCC Moving to #2 in Colombia:

We are also excited to announce to you that we have contracted to purchase 2,340 additional acres of coffee land adjacent to our existing farms, which nearly doubles our existing landholdings. This acquisition positions the GCC to become the #2 largest coffee producer in all of Colombia as we finish planting additional coffee trees at our farms, which process is already substantially underway.

We are excited to share highlights of this acquisition with you below:

“La Troya” Deal Highlights:

1. Scale: With this acquisition and the development of the acquired land, we can become the #1 coffee producer in Colombia with our 4,700 acres of available farmland prior to our projected 2025 sale or IPO without the need for any further acquisitions.

2. Quick Payback Period: We expect only a 3-4 year payback period to recover 100% of the expense of this investment. The annual return on investment is based on conservative go-forward coffee pricing and production figures.

3. Unprecedented Pricing: We are acquiring this land on more favorable pricing terms than any of our prior acquisitions. Since our last round of acquisitions, the U.S. Dollar has strengthened against the COP, from 1 dollar for approximately 3,000 COP to 1 dollar for approximately 4,000 COP. Coffee sales prices have also more than doubled over this same period, making this land substantially more valuable than it was just a short time ago. We purchased our existing farms for $2.66 million under market value, per a third-party independent valuation. We see equal or greater value here given the purchase price and that we will not have to make any further material investment into new infrastructure to capture all value from these farms given their proximity to our current farms and our world-class coffee processing facilities.

4. Discounts: The sellers of this new land are the same as those of our existing farms, which we are currently seller-financing. As part of this acquisition, and for completing this acquisition, we will pay down in full all financing on all our existing farms and in return receive an additional 2% discount on those payoff amounts.

5. Additional Benefits: This transaction comes with additional benefits. With a post-transaction balance sheet of approximately $18 million of equity to $3 million of borrowings, we will have the ability to seek the lending we would like for future growth to become #1 in Colombia, pursue additional strategic acquisitions and enter the U.S. roasted coffee market on our path to the company sale or IPO that we have projected for investors at even higher overall expected financial returns.

Offer Terms

We have decided to extend the Series B funding round due to incredible investor demand and to complete the acquisition of La Troya described above.

Given our current cash position made up of the equity remaining from the $9.6 million funding round and $3 million of debt financing that we were able to obtain in Colombia at a blended annual rate of 5.3% (approximately 2% below Colombian governmental borrowing rates and with a 12-month grace period), we have approximately $4.2 million of cash-on-hand – capital sufficient to complete the acquisition without additional equity investment.

That said, we want to give investors a chance to own GCC on favorable terms while we use the debt financing that we have for working capital and a reserve for additional opportunities given the time it can take to work through the process of obtaining favorable lending.

Therefore, we are giving all investors a chance to invest at the $700 per share price that we just offered in the Series B funding round Since that offering began, we have financed the business with almost $10 million of equity and become the most technologically-advanced coffee company in Colombia, making the GCC much more valuable than it was when we started the offering despite now continuing to maintain the same share price for investors.

We expect to raise this $3.5 million quite quickly. The final $3.5 million of the original $9.6 million came in in just about three weeks.

You can begin your investment now by emailing us at investor.relations@legacy-group.co with the amount that you would like to invest or to schedule a time to discuss the offering.

We hope to welcome more and more investors into this exciting opportunity as we continue on our path to becoming the largest coffee producer in Colombia.

This communication contains forward-looking statements that represent our beliefs, projections and predictions about future events or our future performance. These forward-looking statements are necessarily subjective and involve known and unknown risks, uncertainties and other important factors that could cause our actual results, performance or achievements or industry results to differ materially from any future results, performance or achievements described in or implied by such statements. You should not place undue reliance on these forward-looking statements because such statements speak only as to the date when made. You should review in detail and with your advisors all materials related to this offering before making an investment decision.

Economist by trade, spent 15 years working for HSBC in a multitude of capacities in its Private Wealth, Credit Risk Management and Investment Banking divisions. Furthermore, Jesus worked for the bank in multiple countries. Prior to leaving HSBC, Jesus was the Global Account Owner of the bank’s relationship with the world’s largest accounting and consulting firms.

Upon leaving Wall Street, Jesus joined a boutique Medical Group in Beverly Hills, as CEO, with the primary goal of leading the team through a process of corporate transformation from a small enterprise to a corporation able to navigate the terrain of bringing in Private Investors and expand into new markets: New York, Orange County, Chicago and San Diego.

In addition to extensive professional experience, Jesus holds degrees in Economics (BA – St Mary’s University, and MA – Fordham University) and Finance (MS – University of Rochester).

After multiple combat tours with the U.S. Marine Corps Reserves and obtaining a Bachelor’s Degree in Finance and Real Estate from the University of Florida, Dustin took a position in corporate finance with Lockheed Martin, followed shortly by obtaining his Series 7 and 66 certifications as a Financial Advisor at Edward Jones. Looking for an opportunity to implement his leadership earned in the Marine Corps and entrepreneurial desire, Dustin decided to leave the corporate environment and joined a family-owned private prisoner transportation start-up, while also investing in real estate. Over the next several years, Dustin became a partner in the company, moved into the role of Executive Director and helped grow the company through strategic relationships, winning large government contracts, and helping foster several mergers, ultimately getting the business to a successful sale. After obtaining his MBA in Real Estate from Florida State University in 2020, Dustin continued to invest in real estate, taking a specific interest in land acquisition and development to create equity and cash flow opportunities. Additionally, he was involved with several start-ups and became one of the largest investors in The Green Coffee Company, a Legacy Group portfolio company. After getting boots-on-the-ground with his Green Coffee Company investment in Colombia, Dustin saw an opportunity to become more than just a passive shareholder and joined Legacy Group as the VP of Business Development in June 2022.

Dustin has earned a reputation for his genuine leadership style, adaptive problem-solving skills, ability to forge authentic relationships, and being a fast-moving action-taker across multiple industries. His fluidity and adaptive results-oriented mindset makes Dustin an excellent addition to Legacy Group as our VP of Business Development.

Dustin lives in St. Petersburg, Florida with his wife Jenny and their German Shepherd, Kimber. Going on 18-years in the USMC, Dustin will retire after 20 years and continue to focus on adding value to Legacy Group Stakeholders.